As a CPA, you’ve spent your career helping clients navigate complex financial situations and plan for their futures. But when it comes to your own retirement, are you accurately anticipating your income sources? Many Americans, and even CPAs, have serious misconceptions about their retirement income – frequently through no fault or intention of their own. In this article, we’ll explore the discrepancies between expected and actual retirement income sources, the reasons behind these disparities, and how CPAs can better prepare for their golden years by working with specialized financial professionals.

What Are The Actual Sources Of Your Retirement Income?

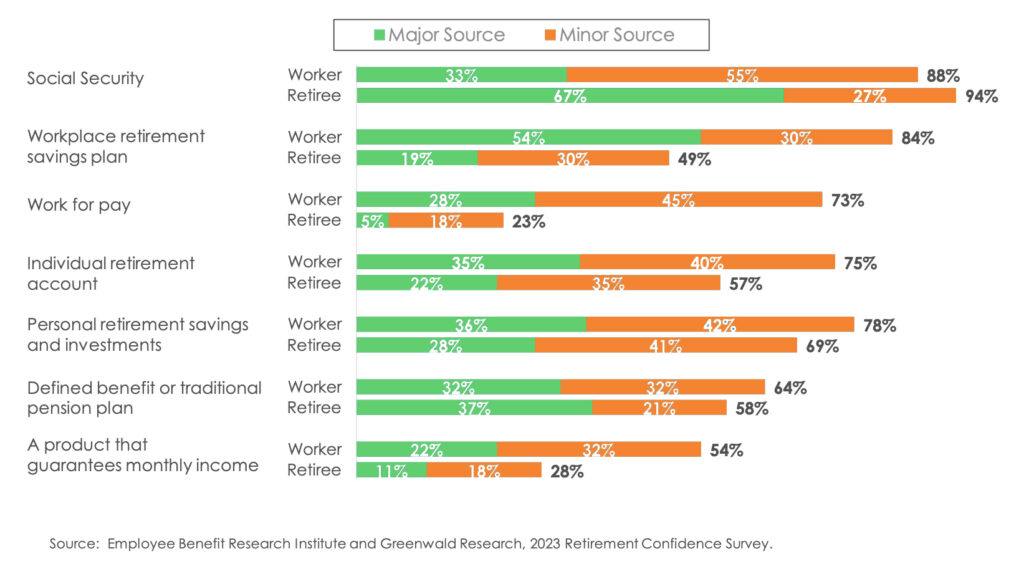

A significant number of Americans believe that their primary retirement income will come from workplace retirement plans. However, a comparison between these expectations and actual experiences reveals a striking difference.

The Employee Benefit Research Institute posed the following question to over a thousand individuals currently saving for retirement and another thousand already retired:

“To what extent do you anticipate the following to be/have been a source of income during your retirement?”

As we can see from the graph above, Social Security’s importance is often underestimated, while workplace retirement savings, IRA savings, and personal savings are overemphasized.

Why the discrepancy, and, most importantly, how does that affect American retirements?

Early Retirement: A Common Trend Among Americans

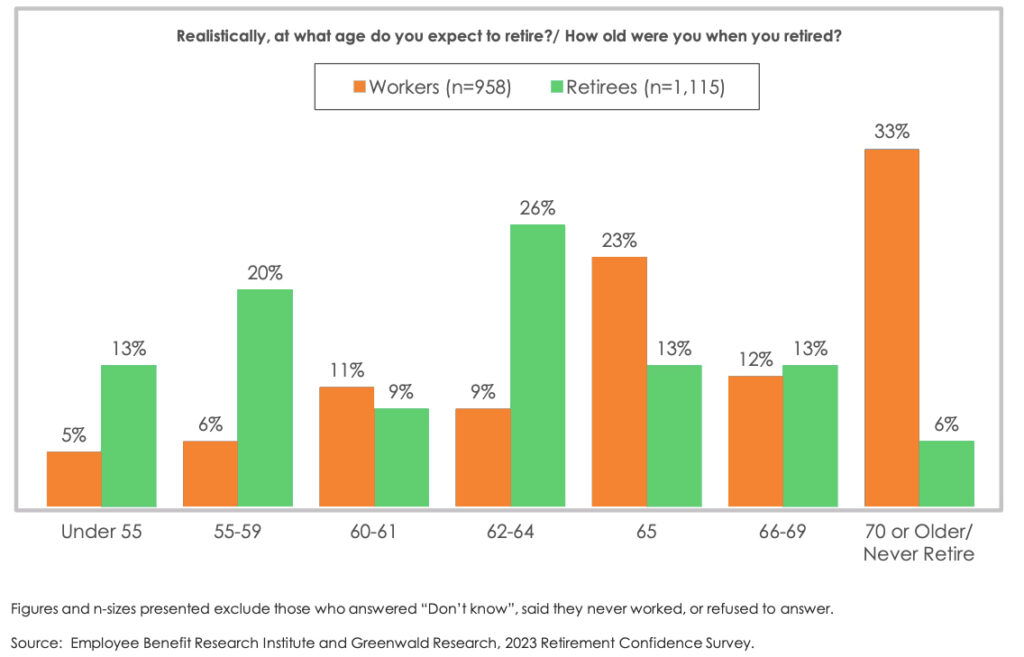

As mentioned, Americans are retiring earlier than expected.

Let’s revisit the EBRI 2023 Retirement Confidence Survey to understand the situation better.

The median age at which workers anticipate retiring is 65.

In reality, the median retirement age for retirees is 62.

This data indicates that many Americans expect to retire later than they actually do. Consequently, they have fewer years to contribute to their retirement and personal investment accounts, resulting in an overreliance on Social Security benefits to bridge the gap.

Moreover, many Americans retire before they become eligible for Social Security benefits, forcing them to use their retirement assets before receiving their first Social Security check. Instead of benefiting from additional years of savings and compound gains, early retirement leads to a more rapid depletion of their savings and a smaller Social Security check.

Working After Retirement: Expectations vs. Actual Trends

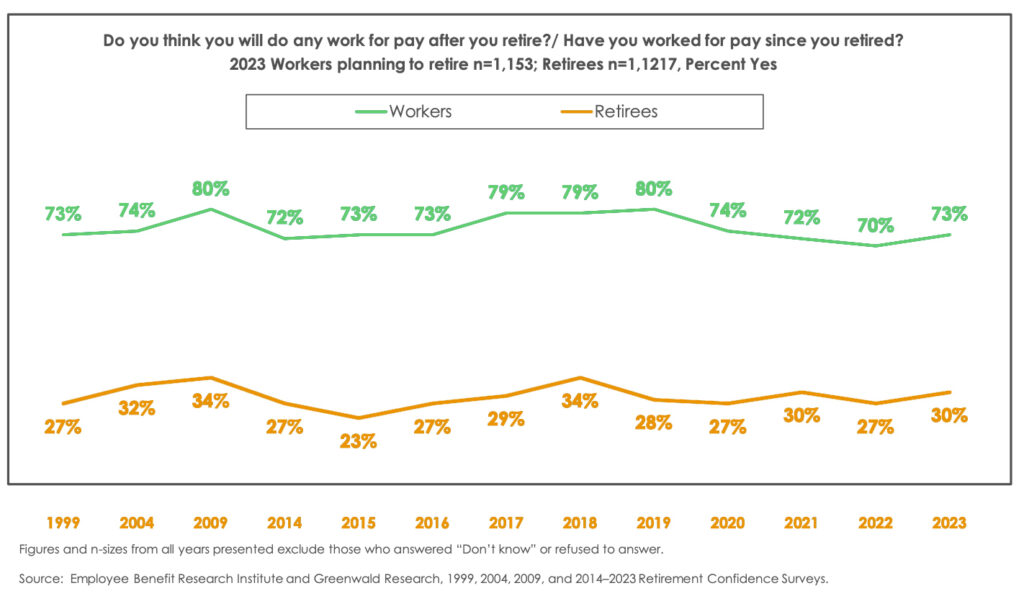

Retirement doesn’t necessarily mean the end of all work. There are numerous opportunities to continue earning during your golden years, such as launching a small business or working part-time in a less demanding role than the corporate career you pursued for decades. In fact, many Americans intend to work in retirement to supplement their income. However, despite their best intentions, many fail to follow through on their plans.

Once again, the Retirement Confidence Survey exposes a significant disparity between expectations and reality over the years. While it may appear that Americans plan to work in retirement but ultimately change their minds, other factors are at play, and often, the choice is not theirs to make.

Why Are Americans Retiring Earlier Than Planned?

As we have learned from the charts above, Americans are retiring earlier than planned, and only some are earning an income via a job in retirement, even though they believed they would. Why is this happening? Are Americans financially set for a sound retirement earlier than expected?

If only that were the case!

A Transamerica Center for Retirement Studies survey found that 56% of retirees retired earlier than planned for a variety of reasons, but health issues are by far the king of all reasons. Naturally, no one expects to become disabled or too ill to work, but unfortunately, it accounts for about 45% of early retirements. This is precisely why we should plan for such factors.

The next biggest factor, affecting about 29% of early retirees, was unexpected organizational changes and layoffs at work. Unfortunately, it’s no secret that older Americans face challenges when seeking new employment, leaving many near retirement age involuntarily unemployed and forced into early retirement. And in case you haven’t been paying attention, artificial intelligence will likely bring many more Americans into early retirement in the near future, so we can expect to see that 29% figure skyrocket.

Next, we have family reasons. Many of us retire early to care for a loved one, accounting for 12% of cases. Again, this can be planned for via alternative financial solutions to help alleviate the disruption these incidents can cause.

Finally, how many Americans retired early because they felt they could afford it? Only about 17%. As a CPA, you’ve probably just figured out that the numbers aren’t exactly adding up. That’s because the survey allowed respondents to choose multiple factors, so perhaps one became a caretaker precisely because they could afford to, or they didn’t seek another job after getting laid off because they didn’t need to.

So, perhaps the situation isn’t so completely dire – but it’s still much worse than it needs to be.

Well, What’s Wrong With Depending On Social Security?

Social Security benefits, even in the best-case scenario, are not a windfall and likely won’t let you maintain the retirement you always dreamed of. In 2024, the highest possible monthly payout for someone reaching age 70 is $4,873 – before taxes. Keep in mind that up to 85% of your Social Security benefits can be subject to taxation.

For some, this amount may be sufficient, but for many, it will fall significantly short. Additionally, though unlikely, Social Security could always see the ax or a defunding. Social Security has become a highly politicized social program, and all it would take is one gust of political change to throw off a whole generation’s retirement plans.

If you currently enjoy a comfortable lifestyle and aspire to an even better one in retirement, when you’ll finally have time for all those dreams, it’s essential not to rely on Social Security. Instead, take proactive steps to generate as much savings as possible and explore alternative solutions to help prevent you from waking up one day with Social Security as your primary source of income – and a much smaller source than you expected.

Bridging the Income Gap

Unexpected early retirement and health issues can create a significant income gap during your golden years. To address this challenge, consider incorporating annuities and cash-value life insurance into your retirement plan. These financial tools can provide a reliable income stream and help fill the hole created by unforeseen circumstances, such as disability, illness, and forced retirement.

Annuities are insurance contracts that offer regular payments in retirement, either immediately or deferred to a later date. They can be structured to provide income for life, ensuring that you won’t outlive your savings. Additionally, annuities often come with guaranteed minimum return rates, protecting your retirement funds from market volatility and offering one of the most valuable things in retirement – stability.

Cash-value life insurance, on the other hand, combines a death benefit with a cash-value component that accumulates over time. This cash value can be accessed during your lifetime, providing an additional source of income in retirement, especially useful in times of disability, illness, and unexpected job loss. Moreover, cash-value life insurance policies typically offer tax-deferred growth, which can enhance the efficiency of your retirement savings and tax plan.

Final Thoughts

While retirement can indeed provide well-deserved rest and relaxation after a lifetime of hard work, the transition from expectations to reality, especially concerning retirement income, can be substantial and potentially anguishing. Unforeseen early retirement, unexpected life events, and miscalculations of required savings can lead to an overreliance on Social Security benefits, which often fall short of supporting the lifestyle you envision, with consequences that can last the rest of your life.

Our advice for CPAs? Begin saving early, prioritize your health, and consider working longer to alleviate pressure on your savings. Additionally, sit down with a professional to optimize your Social Security claiming strategy and explore alternative income sources to help supplement your retirement funds.

At CPA Retirement Solutions, we specialize in helping CPAs bridge the gap between expectations and reality with tailored solutions that carefully factor in every possible scenario.

We’ll help you achieve long-term financial success and the retirement you’ve always dreamed of. If this resonates with you, click the button below to take the first step.