Custodial Roth IRAs: A CPA’s Guide to Family Financial Planning

We all want our kids to grow up with strong financial habits, a solid work…

Is Early Retirement a CPA’s Best Move or Biggest Gamble?

When you’re young, your greatest resources are your time and health, though you likely don’t…

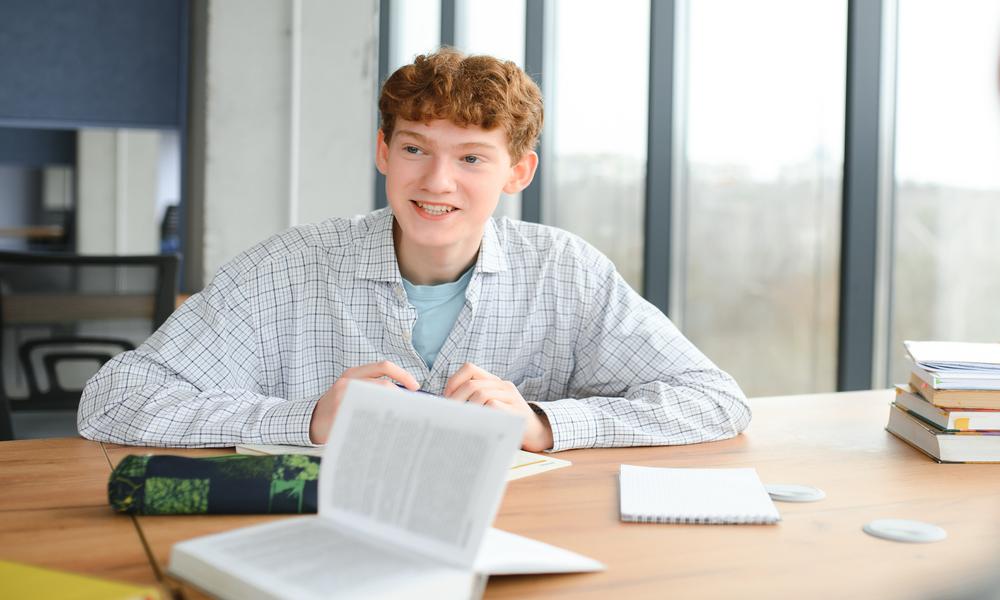

Raising Financially Savvy Kids: Practical Steps for Accountants

As an accountant, you’re well-versed in managing finances, preparing budgets, and planning for the future,…

How Annuities Are Used In Retirement Planning

What’s your greatest retirement concern? Whether it’s inflation, health issues, or even the challenge of…

Why CPAs Need Long-Term Care Insurance

America is facing a growing health crisis, one largely driven by our own daily habits.…

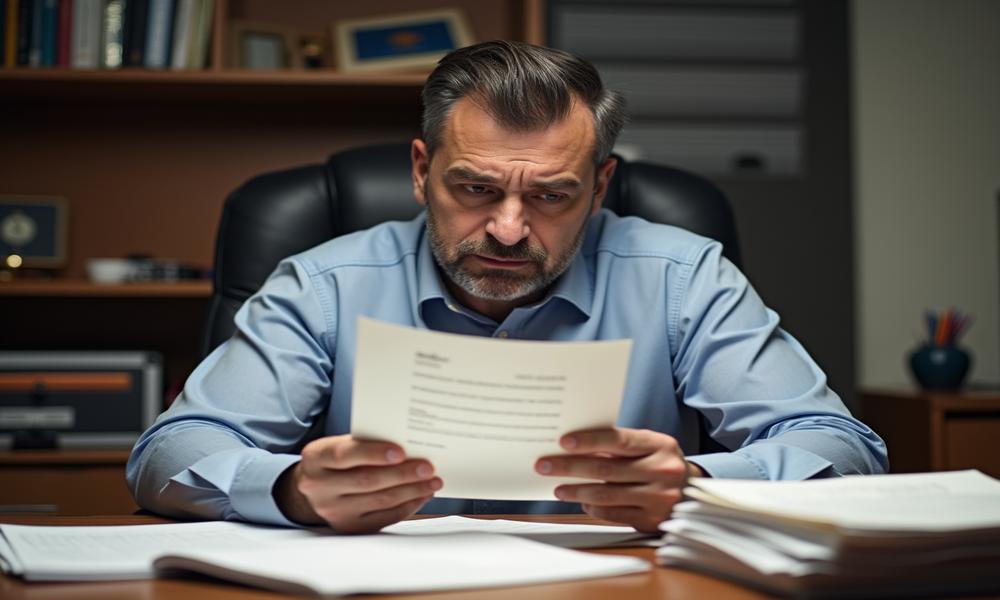

Protect What You’ve Earned: A CPA’s Roadmap to Asset Security

You open your mailbox one day to find a certified letter waiting for you. As…

Understanding the Ten Year Rule for Inherited IRAs

We are on the cusp of one of the most significant economic shifts in modern…

Are You Overlooking Key Components of Your Financial Plan?

CPAs are great with numbers and assisting clients maximize tax savings for the year. However,…

Family Limited Partnerships vs. Family LLCs: Choosing the Best Structure

As a CPA and owner of an accounting firm, you’ve spent years building your practice…

Digital Estate Planning for CPAs: Securing Your Online Future

As financial professionals, CPAs understand the critical role of estate planning in preserving legacies and…

The Key Sections of Medicare: Essential Knowledge for CPAs

As a CPA, you’ve had a long and stressful career, and it has likely affected…

How to Manage Healthcare Costs via Investing (and Save On Taxes)

The taxman seems to follow us everywhere, right? He taxes our salaries, our properties, our…